No Code

Algorithmic Trading

Sparkster is building a platform that bring’s Algorithmic Trading to the masses. By empowering people to define trading strategies in Plain English, we’re revolutionizing this space. Crypto and tools such as Trading View have spawned the emergence of a new class of trader, one with an understanding of technical indicators, but often without the programing background to implement sophisticated back testing, risk management, strategy ranking, indexing, rules based position sizing and automated trade execution. All necessary components to an effective Algo Trading implementation.

Enter The Sparkster No Code Algorithm Trading Platform. The platform enables traders to be able to quickly and easily implement effective trading strategies in a matter of minutes, using simple blocks of logic in plain English, all without the need to know any advanced programming languages. So whether you are a new trader or an advanced one, you can quickly test and implement your strategies to optimize your portfolio’s success, all while effectively managing risk.

Those wishing to invest in algorithmic trading, but without the understanding of technical indicators, or ideas for new strategies can invest in strategies that are shared by others in the community. In exchange for a percentage of profits that are shared with strategy author, we hope to create a healthy ecosystem that encourages those with the knowledge, to share, and those with capital to trade and profit in greater volumes.

Who is Sparkster

Sparkster has spent the last several years developing codeless software development tools to enable people with ideas to manifest those ideas in software, without the impediment of learning to code. Democratizing access to technology is at the heart of our mission. Algorithmic trading takes our mission to the next level, giving us a platform to share our vision and mission and demonstrating the powerful and life changing impact our technology can have.

TRADERS

Problem We’re Solving:

The Sparkster No Code Algorithmic Platform permits traders to test their strategies by enabling a full back testing suite. Traders can not only test their strategies but in fact the best strategies can compete on performance. Traders can actually follow the most successful strategies of their choice and participate in its success.

This has the potential to substantially reduce the time, effort and knowledge required to implementation of Algorithmic Trading, encouraging existing platform users and reducing barriers to entry and encouraging larger trading volumes.

1. Trading View - language impediments to composing and implementing strategies.

2. Limited time to trade actively - passive autonomous trading substantially increases trading volumes.

3. Reduce barriers to algo trading by allowing other to invest in your strategy, and earn a percentage of profits.

How It Works

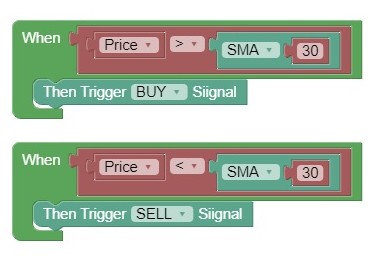

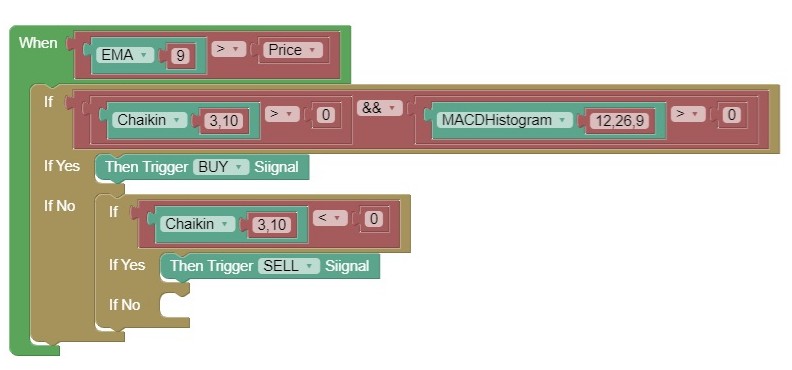

Define Strategies in Plain English (other languages support in the future).

Users can select from a series of pre-populated standard indicators, and instantly snap them together to create quick buy and sell indicators, using blocks of logic in plain english.

1. Compose strategies using an unlimited number of public and even custom indicators - including MACD, RSI, Bollinger Bands, Ichimoku Cloud, Aroon, EMA, ATR, Williams %R etc.

2. Combine indicators and use conditions for each indicator in a simple intuitive manner. For example:

a. When Price crosses the upper Bollinger Band, trigger a buy single.

b. When Price crosses the upper Bollinger Band AND Price > EMA(9), then trigger a buy signal.

3. No need to worry about the implementation of these standard indicators, choose from a menu of pre-populated indicators and snap strategies together in plain intuitive English.

4. Define rules for when to enter and exit trades by triggering buy/sell signals.

Full Back Testing Suite

1. Once a strategy has been composed, a suite of performance metrics are calculated automatically for each strategy allowing you to compare strategies that yield the best performance.

2. Strategies can be compared against each other in terms of the following metrics:

- Expected Value (Expected Profit per Trade)

- Win Rate

- Risk/Reward Ratio

- Max Drawdown

- Net Profit over x period

- Average Trading Period (Average length of each trade)

- ROIC

3. Compare performance for different time intervals - e.g. 1 min, 3 min, 5 min, 15 mins, 30 min, 1 hour, 2 hour, 4 hour, 24 hour.

Allocation

- Build a Strategy Index of top performing strategies and define your own Strategy Ranking Metric based on any combination of the performance metrics above, or choose our default recommended metric.

- Allocate capital accordingly to each Strategy Index.

- Automatically determine position size based on risk/reward ratio, win rate or other metric.

- Define max position size per strategy or per index to limit risk.

Risk Management and Governance - all in Plain English

- Define global stop loss rules that are applied to each trade.

- Define rules for active loss mitigation strategies such as Max Drawdown, Max number of consecutive losses.

- Define rules for general market conditions, for example trades may only be executed if SMA(50) > SMA(200).

- Define global max position sizes.

Rules Based Automated Execution

- Trade execution over REST API with OAUTH security. Each client would log into their trading account via OAUTH granting our platform permission to execute transaction on their behalf.

- Define maker rules to set execution price e.g. 5c +/- bid/ask.

- Set rules for global cancellation - e.g. all unfilled trades cancelled after 30 mins.

- Set rules for generating replacement orders for unfulfilled portions of an allocation - e.g. Increase / reduce execution price to follow the market by up to 2% of the triggered execution price.

Share Strategies / Index publically

- Set a percentage of profits fee for copycat investors to participate.

- Encourage non sophisticated traders to benefit from knowledge of others.

- Comment / like strategies and indexes.

- Rank strategies and index based on performance metrics or Sharpe Ratio and encourage competition.

- Substantially increase trading volume.